- HOME

- Sustainability

- Green and Social Finance

KDXR positions sustainability improvement initiatives aiming to realize a sustainable society as an important business management issue as a part of its corporate social responsibility. KDXR promotes to further strengthen its sustainability efforts through utilizing green finance and social finance, as well as to contribute to development of the domestic market by providing opportunities to investors and financial institutions active in ESG investment.

- Green Finance Framework

- Social Finance Framework

- Reporting based on Green Finance Framework

- Reporting based on Social Finance Framework for former KDR

- Status of Finance

Green Finance Framework

KDXR has established the "Green Finance Framework", a basic policy for green finance, and shall follow the framework when obtaining green finance.

1. Use of Proceeds

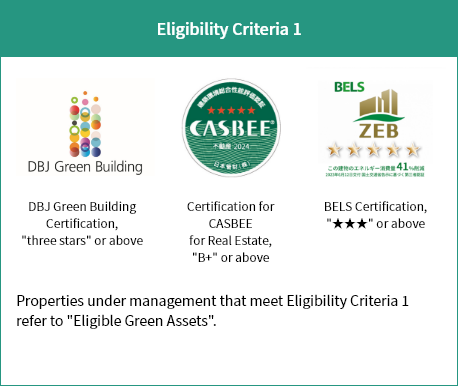

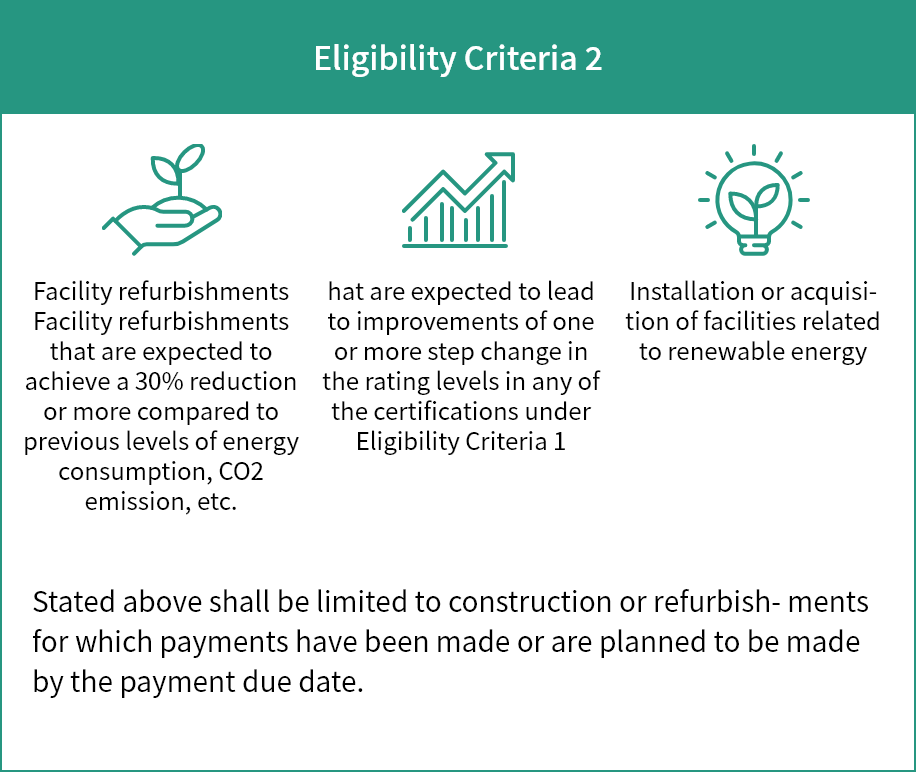

Use of net proceeds from green finance is limited to finance (1) the acquisition of assets that meet Eligibility Criteria 1 stated below, the repayment of borrowings and the redemption of investment corporation bonds, and (2) construction and/or facility refurbishments for energy saving that meet Eligibility Criteria 2.

2. Project Evaluation and Selection Process

The Sustainability Department, which is a secretariat for the Sustainability Committee established in the Asset Management Company and the Listed REIT Department, which handles operations related to the Asset Management Company’s asset management, act as the center of operations relating to sustainability, including green projects that meet the criteria for the allocation of proceeds (“Eligible Green Projects”).

The Sustainability Committee is chaired by the President & CEO of the Asset Management Company and consists of the Head of each department, including the Head of Listed REIT Department, Head of Strategic Planning Department, Head of Sustainability Department, Head of Finance & Accounting Department, and other members. The Committee examines and monitors sustainability policies, targets and various initiatives with regard to sustainability while taking into consideration social situations and the asset management status of the Asset Management Company, KDXR and Private REIT.

The selection of Eligible Green Project requires the approval of the Asset Management Committee of Listed REIT Department, which reports to the Sustainability Committee on the evaluation and use of proceeds of Eligible Green Projects, alignment of use of proceeds with Eligibility Criteria, and prospects of the status of allocation of net proceeds after allocating proceeds to Eligible Green Projects.

3. Management of Proceeds and Unallocated Proceeds

The Asset Management Company properly implements internal controls regarding net proceeds and unallocated proceeds.

Net proceeds and unallocated proceeds are managed in exclusive deposit and withdrawal accounts for green finance, separately from other funds (any unallocated proceeds are managed under cash and cash equivalents pending full allocation of net proceeds), and recording of fund transfers and confirmation of outstanding balance are conducted regularly.

4. Reporting

Allocation Reporting

Net proceeds from green finance will be promptly used to acquire eligible green assets or to refinance borrowings or investment corporation bonds required for green projects, only after checking that these projects are linked with payments of expenditures for energy saving related construction, etc. that is recognized as having an effect exceeding predetermined criteria. The status of any unallocated proceeds will be disclosed on this website on an annual basis, with respect to the period until the entire amount of net proceeds is allocated to projects that meet the Eligible Criteria or the period until green finance is redeemed or repaid.

The sum of green finance outstanding amounts will be managed by setting the level of eligible green finance debt as of the end of the immediately preceding fiscal period as the upper limit.

The upper limit amount of green finance = Aggregate amount of acquisition price of Eligible Green

Assets × Total asset LTV + Total investment in Eligibility Criteria 2

We disclose the following indicators throughout the life of the green finance.

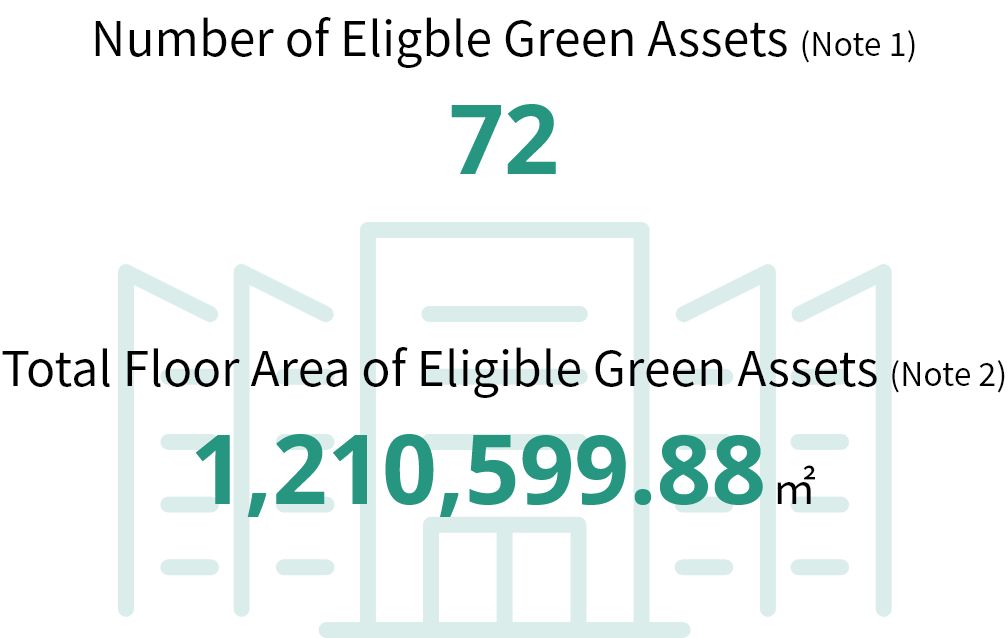

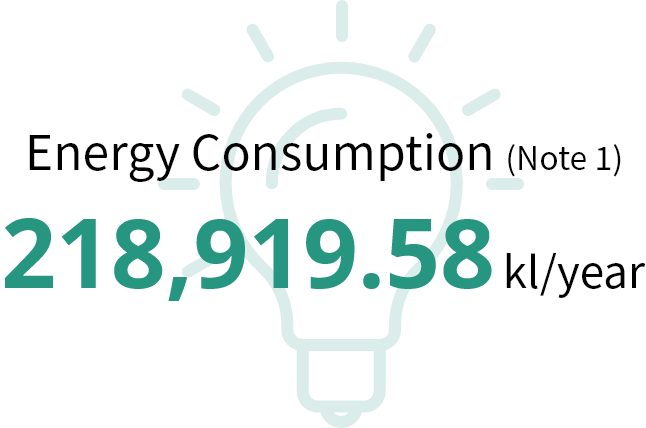

[Eligibility Criteria 1]

・Number and certifications of Eligible Green Assets- Aggregate amount of total floor area of Eligible Green Assets- Energy consumption, Water consumption and CO2 emission of Eligible Green Assets (where KDXR has energy control authority)

[Eligibility Criteria 2]

・In the cases in which construction or facility refurbishments that are expected to result in improvements in terms of energy saving or environmental benefits are implemented, energy consumption, water consumption or estimated reduction rate (percentage) of greenhouse gas emission, etc. before and after the construction or refurbishments

・In the cases in which facilities related to renewable energy are installed or acquired, anticipated annual energy production related to the said facilities

Third-party evaluation of the Green Finance Framework

Japan Credit Rating Agency, Ltd. (JCR)

PDF

Social Finance Framework

1. Use of Funds Procured Through Social Finance

The former Kenedix Residential Next Investment Corporation (“KDR”) allocated the funds procured through social finance to the acquisition of assets eligible for social finance (described in below), repayment of borrowings required for such acquisition and redemption of investment corporation bonds (including refinance).

2. Assets Eligible for Social Finance

Assets eligible for social finance refer to assets fulfilling the following eligibility criteria.

| Senior living facilities |

|

|---|---|

| Medical facilities |

|

Please refer to "Healthcare Facilities" in the list of portfolios for assets eligible for social finance.

3. Selection Criteria and Process of Project

The requirements of assets eligible for social finance are stipulated in the Management Guidelines of Residential REIT Department (former) prepared by the Asset Management Company of KDR. In addition, as for the procurement of social finance, compliance with the eligibility criteria (eligibility criteria in (2) above) of social finance will be screened in the process of decision-making for the acquisition of assets and borrowing of funds.

4. Management of Procured Funds

Debt eligible for social finance is the amount calculated by multiplying the total acquisition price of the assets eligible for social finance in the portfolio of KDR with the ratio of interest-bearing debt to total assets, and the upper limit of social finance will be set.

The maximum amount available for social finance is 38.8 billion yen and KDR currently issues 3.7 billion yen as social bonds and borrows 7.4 billion yen as social loan as of July 31, 2023.

The figures as of the end of April 2024 are as follows.

| Assets eligible for social finance | 76.7 billion yen (39 properties) |

|---|---|

| Debt eligible for social finance | 38.8 billion yen |

Reporting based on Green Finance Framework

Allocation Reporting (Balance of Green Finance and Allocation Status of Proceeds)

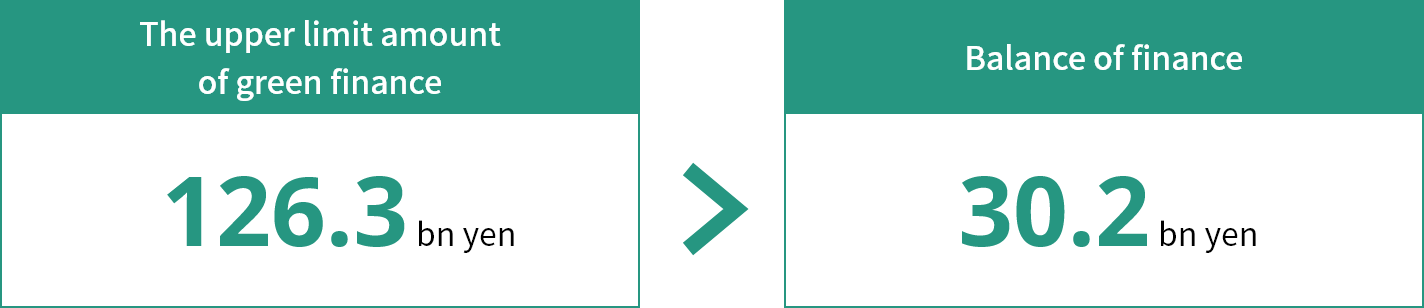

Kenedix Office Investment Corporation (former)

As of August 31, 2023

The balance of green finance does not exceed the upper limit amount of green finance. In addition, there is no unallocated proceeds.

The upper limit amount of green finance is calculated based on the figures as of April 30, 2023.

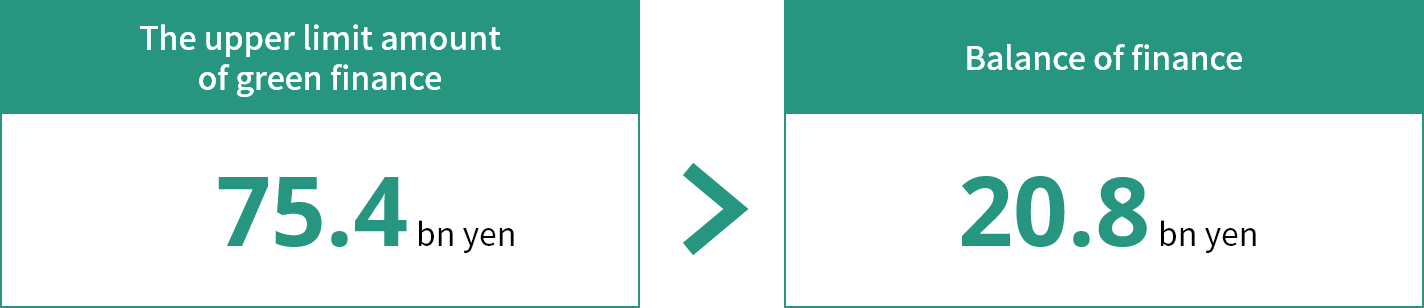

Kenedix Retail REIT Corporation (former)

As of March 31, 2023

The balance of green finance does not exceed the upper limit amount of green finance. In addition, there is no unallocated proceeds.

The upper limit amount of green finance is calculated based on the figures as of March 31, 2023.

Impact Reporting (Reporting on Energy Consumption Indicators)

As of November 1, 2023

| Note 1: | A property that has multiple environmental certifications is counted as one. |

|---|---|

| Note 2: | Calculated based on KDO's interest ratio for buildings, of which KDO has compartmentalized ownership, etc. |

| Note: | Calculated based on the data from April 2012 to March 2022. |

|---|

Reporting based on Social Finance Framework of Former KDR

Former KDR discloses the following output and income indicators.

<Output Indicator>- Overview of building and lease

- Overview of operations (Number of rooms, capacity, occupancy and utilization rate)

- Earnings performance of owned healthcare facilities (details of expenses and NOI)

- Overview of operator

- Appraisal value as of the end of the fiscal period

Note: In case that the operator’s consent has not been obtained, the information is not disclosed.

Please refer to Social Finance Impact Report.PDF

J-REIT and Healthcare Market Size(Acquisition Price)

- Japan Real Estate Securitization Association “ARES J-REIT Databook(March 2023) “

AUM of Healthcare Facilities

(Promotion of understanding and usage of healthcare facilities)

Please click herePDF for further details.

By linking capital market needs with healthcare facilities operators' needs, KDR will promote the provision of superior healthcare facilities and contribute to the promotion of socially beneficial capital investments.

Status of Finance

Green Finance

| Funds (Millions of Yen) |

Procurement Date |

Repayment Date/ Redemption Date |

Allocation | |

|---|---|---|---|---|

| 12th Series Unsecured Bonds Former Kenedix Office Investment Corporation |

1,000 | Oct. 20, 2020 | Oct. 18, 2030 | Allocated |

| 7th Series Unsecured Bonds Former Kenedix Retail REIT Investment Corporation |

2,000 | Jan. 28, 2022 | Jan. 28, 2032 | Allocated |

| 8th Series Unsecured Bonds Former Kenedix Retail REIT Investment Corporation |

2,000 | Jun. 22, 2022 | Oct. 29, 2027 | Allocated |

| Total Amount of Green Bonds (a) | 5,000 | |||

| Green Loan (Series 46-A1) (Former Kenedix Retail REIT Investment Corporation) |

2,600 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

|---|---|---|---|---|

| Green Loan (Series 46-A2) (Former Kenedix Retail REIT Investment Corporation) |

600 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-A3) (Former Kenedix Retail REIT Investment Corporation) |

400 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-A4) (Former Kenedix Retail REIT Investment Corporation) |

400 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-A5) (Former Kenedix Retail REIT Investment Corporation) |

300 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-A6) (Former Kenedix Retail REIT Investment Corporation) |

300 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-B) (Former Kenedix Retail REIT Investment Corporation) |

800 | Feb. 10, 2022 | Jan. 31, 2029 | Allocated |

| Green Loan (Series 46-C) (Former Kenedix Retail REIT Investment Corporation) |

1,600 | Feb. 10, 2022 | Jan. 31, 2031 | Allocated |

| Green Loan (Series 48-A) (Former Kenedix Retail REIT Investment Corporation) |

600 | Aug. 31, 2022 | Feb. 28, 2027 | Allocated |

| Green Loan (Series 48-B1) (Former Kenedix Retail REIT Investment Corporation) |

950 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (Series 48-B2) (Former Kenedix Retail REIT Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (52-A1) (Former Kenedix Retail REIT Investment Corporation) |

600 | Mar. 31, 2023 | Mar. 31, 2024 | Allocated |

| Green Loan (52-A2) (Former Kenedix Retail REIT Investment Corporation) |

400 | Mar. 31, 2023 | Mar. 31, 2024 | Allocated |

| Green Loan (52-A3) (Former Kenedix Retail REIT Investment Corporation) |

400 | Mar. 31, 2023 | Mar. 31, 2024 | Allocated |

| Green Loan (52-B) (Former Kenedix Retail REIT Investment Corporation) |

500 | Mar. 31, 2023 | Mar. 31, 2026 | Allocated |

| Green Loan (52-C) (Former Kenedix Retail REIT Investment Corporation) |

1,350 | Mar. 31, 2023 | Mar. 31, 2027 | Allocated |

| Green Loan (52-D) (Former Kenedix Retail REIT Investment Corporation) |

1,500 | Mar. 31, 2023 | Sep. 30, 2028 | Allocated |

| Green Loan (52-E1) (Former Kenedix Retail REIT Investment Corporation) |

1,500 | Mar. 31, 2023 | Sep. 30, 2029 | Allocated |

| Green Loan (52-E2) (Former Kenedix Retail REIT Investment Corporation) |

600 | Mar. 31, 2023 | Sep. 30, 2029 | Allocated |

| Green Loan (52-F) (Former Kenedix Retail REIT Investment Corporation) |

150 | Mar. 31, 2023 | Mar. 31, 2030 | Allocated |

| Green Loan (54) (Former Kenedix Retail REIT Investment Corporation) |

500 | Sep. 29, 2023 | Sep. 30, 2028 | Allocated |

| Green Loan (197-E) (Former Kenedix Office Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2025 | Allocated |

| Green Loan (197-G) (Former Kenedix Office Investment Corporation) |

2,400 | Aug. 31, 2022 | Aug. 31, 2027 | Allocated |

| Green Loan (197-H) (Former Kenedix Office Investment Corporation) |

1,000 | Aug. 31, 2022 | Aug. 31, 2027 | Allocated |

| Green Loan (197-I) (Former Kenedix Office Investment Corporation) |

300 | Aug. 31, 2022 | Aug. 31, 2027 | Allocated |

| Green Loan (197-K1) (Former Kenedix Office Investment Corporation) |

1,000 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-K2) (Former Kenedix Office Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-K3) (Former Kenedix Office Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-K4) (Former Kenedix Office Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-K5) (Former Kenedix Office Investment Corporation) |

200 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-M1) (Former Kenedix Office Investment Corporation) |

1,000 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (197-M2) (Former Kenedix Office Investment Corporation) |

500 | Aug. 31, 2022 | Aug. 31, 2029 | Allocated |

| Green Loan (198-B) (Former Kenedix Office Investment Corporation) |

500 | Oct. 31, 2022 | Apr. 30, 2026 | Allocated |

| Green Loan (199) (Former Kenedix Office Investment Corporation) |

1,000 | Feb. 28, 2023 | Feb. 29, 2028 | Allocated |

| Green Loan (200-A) (Former Kenedix Office Investment Corporation) |

2,000 | Mar. 13, 2023 | Mar. 31, 2030 | Allocated |

| Green Loan (200-B) (Former Kenedix Office Investment Corporation) |

1,800 | Mar. 13, 2023 | Mar. 31, 2031 | Allocated |

| Green Loan (201) (Former Kenedix Office Investment Corporation) |

500 | Jun. 30, 2023 | Jun. 30, 2026 | Allocated |

| Green Loan (202-B) (Former Kenedix Office Investment Corporation) |

500 | Jul. 31, 2023 | Jul. 31, 2029 | Allocated |

| Green Loan (203-B1) (Former Kenedix Office Investment Corporation) |

2,000 | Aug. 31, 2023 | Aug. 31, 2026 | Allocated |

| Green Loan (203-B2) (Former Kenedix Office Investment Corporation) |

300 | Aug. 31, 2023 | Aug. 31, 2026 | Allocated |

| Green Loan (0001-B) | 1,200 | Nov. 1, 2023 | Nov. 30, 2024 | Allocated |

| Green Loan (0001-C) | 1,000 | Nov. 1, 2023 | Oct. 31, 2026 | Allocated |

| Green Loan (0001-D1) | 1,000 | Nov. 1, 2023 | Oct. 31, 2027 | Allocated |

| Green Loan (0001-D2) | 1,000 | Nov. 1, 2023 | Oct. 31, 2027 | Allocated |

| Green Loan (0001-E) | 1,000 | Nov. 1, 2023 | Apr. 30, 2028 | Allocated |

| Green Loan (0001-F1) | 1,000 | Nov. 1, 2023 | Oct. 31, 2028 | Allocated |

| Green Loan (0001-F2) | 500 | Nov. 1, 2023 | Oct. 31, 2028 | Allocated |

| Green Loan (0007-A1) | 1,200 | Jan. 31, 2024 | Oct. 31, 2027 | Allocated |

| Green Loan (0007-B) | 750 | Jan. 31, 2024 | Oct. 31, 2028 | Allocated |

| Green Loan (0007-C1) | 1,000 | Jan. 31, 2024 | Jan. 31, 2029 | Allocated |

| Green Loan (0007-E1) | 1,000 | Jan. 31, 2024 | Jan. 31, 2031 | Allocated |

| Green Loan (0009) | 2,000 | Feb. 15, 2024 | Oct. 31, 2029 | Allocated |

| Green Loan (0010-A) | 2,500 | Feb. 29, 2024 | Apr. 30, 2027 | Allocated |

| Green Loan (0010-B1) | 2,700 | Feb. 29, 2024 | Apr. 30, 2029 | Allocated |

| Green Loan (0010-C1) | 1,500 | Feb. 29, 2024 | Oct. 31, 2029 | Allocated |

| Green Loan (0011-A) | 2,000 | Mar. 25, 2024 | Oct. 31, 2029 | Allocated |

| Green Loan (0011-B) | 3,000 | Mar. 25, 2024 | Apr. 30, 2030 | Allocated |

| Green Loan (0012-A) | 1,000 | Mar. 29, 2024 | Apr. 30, 2029 | Allocated |

| Green Loan (0012-B) | 1,400 | Mar. 29, 2024 | Oct. 31, 2030 | Allocated |

| Green Loan (0013-A2) | 300 | Apr.30,2024 | Apr.30,2025 | Allocated |

| Green Loan (0013-C) | 1,000 | Apr.30,2024 | Apr.30,2028 | Allocated |

| Green Loan (0013-D1) | 2,000 | Apr.30,2024 | Apr.30,2029 | Allocated |

| Green Loan (0013-D2) | 1,000 | Apr.30,2024 | Apr.30,2029 | Allocated |

| Green Loan (0013-E) | 1,100 | Apr.30,2024 | Oct.31,2030 | Allocated |

| Green Loan (0013-F1) | 4,600 | Apr.30,2024 | Apr.30,2031 | Allocated |

| Green Loan (0013-F2) | 2,000 | Apr.30,2024 | Apr.30,2031 | Allocated |

| Green Loan (0013-F3) | 1,000 | Apr.30,2024 | Apr.30,2031 | Allocated |

| Total Amount of Green Loans (b) | 73,300 | |||

| Total Amount of Green Finance (a+b) | 78,300 | |||

Social Finance

| Funds | Procurement date |

Repayment date/ Redemption date |

Allocation | |

|---|---|---|---|---|

| 6th Series Unsecured Bonds Former Kenedix Residential Next Investment Corporation |

2,000 | Dec. 20, 2019 | Dec. 20, 2029 | Allocated |

| 7th Series Unsecured Bonds Former Kenedix Residential Next Investment Corporation |

1,700 | May 31, 2021 | May 31, 2031 | Allocated |

| Total Amount of Social Bonds (c) | 3,700 | |||

| Social Loan (55-A) (Former Kenedix Residential Next Investment Corporation) |

1,000 | Jul. 30, 2021 | Jul. 31, 2024 | Allocated |

|---|---|---|---|---|

| Social Loan (60-D) (Former Kenedix Residential Next Investment Corporation) |

1,000 | Dec. 10, 2021 | May 31, 2029 | Allocated |

| Social Loan (68-D) (Former Kenedix Residential Next Investment Corporation) |

1,100 | Jul. 29, 2022 | Jul. 31, 2027 | Allocated |

| Social Loan (73) (Former Kenedix Residential Next Investment Corporation) |

1,300 | Dec. 13, 2022 | Nov. 30, 2026 | Allocated |

| Social Loan (75) (Former Kenedix Residential Next Investment Corporation) |

500 | Jan. 31, 2023 | Jan. 31, 2028 | Allocated |

| Social Loan (81-A) (Former Kenedix Residential Next Investment Corporation) |

200 | Jul. 31, 2023 | Jul. 31, 2026 | Allocated |

| Social Loan (81-B) (Former Kenedix Residential Next Investment Corporation) |

600 | Jul. 31, 2023 | Jan. 31, 2028 | Allocated |

| Social Loan (81-C1) (Former Kenedix Residential Next Investment Corporation) |

400 | Jul. 31, 2023 | Jul. 31, 2028 | Allocated |

| Social Loan (82-B1) (Former Kenedix Residential Next Investment Corporation) |

300 | Jul. 31, 2023 | Jul. 31, 2026 | Allocated |

| Social Loan (82-B2) (Former Kenedix Residential Next Investment Corporation) |

300 | Jul. 31, 2023 | Jul. 31, 2026 | Allocated |

| Social Loan (82-B3) (Former Kenedix Residential Next Investment Corporation) |

200 | Jul. 31, 2023 | Jul. 31, 2026 | Allocated |

| Social Loan (82-C) (Former Kenedix Residential Next Investment Corporation) |

500 | Jul. 31, 2023 | Jul. 31, 2029 | Allocated |

| Social Loan (84-A) (Former Kenedix Residential Next Investment Corporation) |

1,000 | Aug. 31, 2023 | Aug. 31, 2024 | Allocated |

| Social Loan (84-E) (Former Kenedix Residential Next Investment Corporation) |

1,000 | Aug. 31, 2023 | Aug. 31, 2030 | Allocated |

| Total Amount of Social Loan (d) | 9,400 | |||

| Total Amount of Social Finance (c+d) | 13,100 | |||